No down mortgages is very more pricey than just a traditional loan

Zero offers are essential. The bank completely earnings the purchase of one’s new house. All you have to care about will be your month-to-month home loan repayments. Songs higher, does it not?

Such funds have the potential to ensure it is customers to help you safer a beneficial assets you to most other finance companies would not think offering them a loan with the. Plus Cayman’s latest housing market, it is sometimes the only method somebody access the newest assets hierarchy.

Added Bills

For the reason that the interest rate from which the lending company often charges you focus is significantly large. So what you get paying the financial overall attract (how much cash repaid on top of the cost over the name of the loan) is much greater.

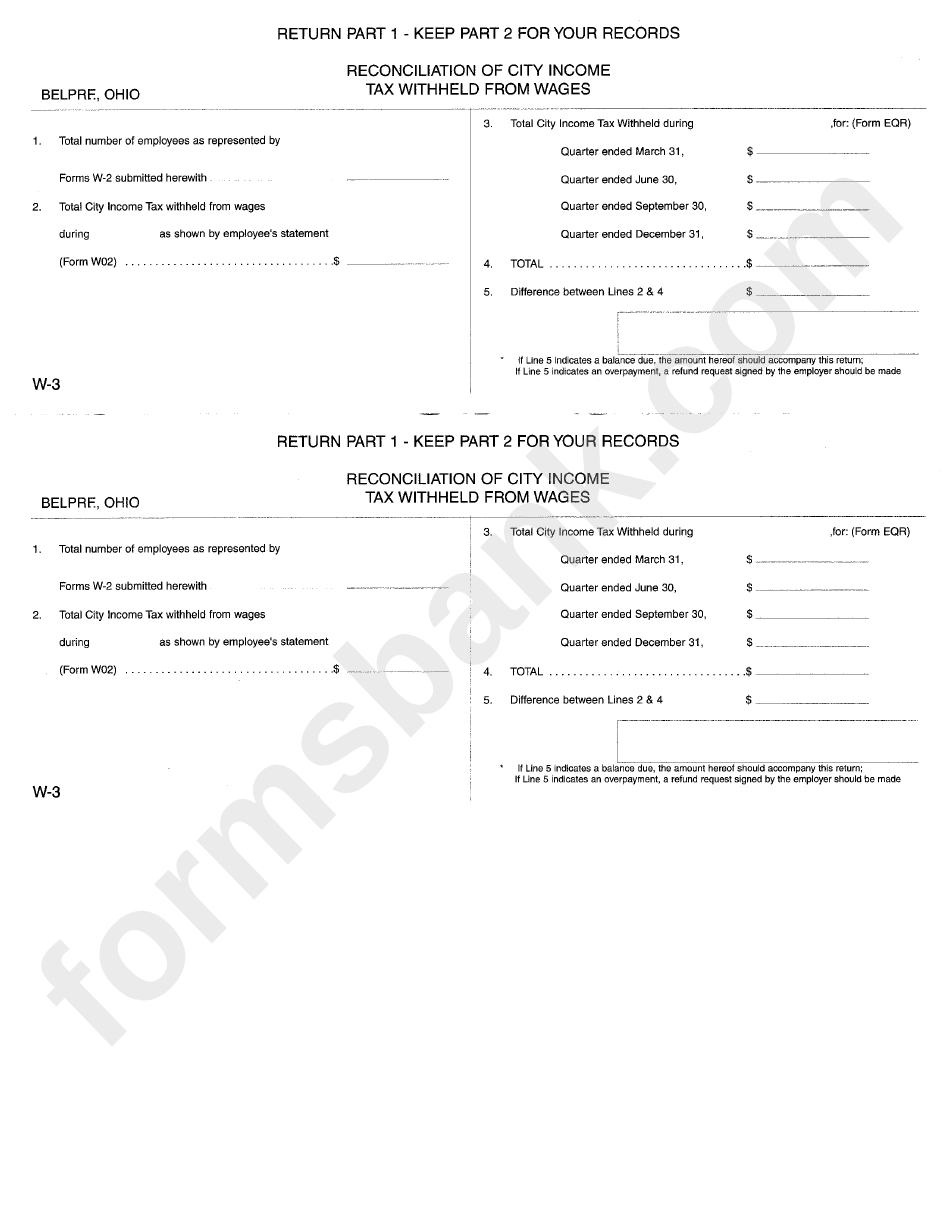

Lower than try a part because of the front comparison off 100% capital and you may a fundamental loan. This case is dependant on current prices to invest in an Isabela Properties property lot, detailed in the CI$29,700 throughout the Cayman Brac.

The bank was incase greater risk when providing 100% investment. This means that, it fees a higher interest to make certain they make their cash back. (más…)