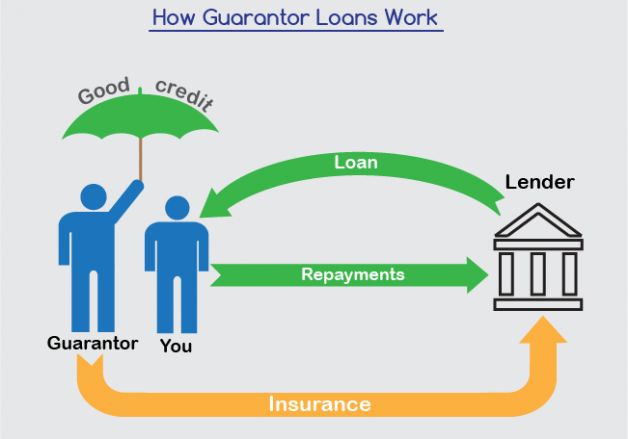

Then he asserted that the loan limitations had been elevated in the market meltdown, however, you to definitely the audience is still scaling them right back

In a number of occasions, they seemed that Chairman Obama challenged their terminology off Phoenix. Spencer said how institutional traders was to shop for up tens of thousands of home off property foreclosure, after which renting them, in some cases into former homeowners, to allow all of them remain in their particular belongings. President Obama recommended that is a best part, and just how its smart 100 % free markets business economics: purchase lower, sell highest. Yet ,, in the Phoenix, he specifically mentioned that homeownership might be symbolic of obligation, perhaps not out of conjecture. But what else is these types of Wall surface Roadway hedge fund starting but guessing?

Authorities is step-in to be certain there clearly was however a 30 year home loan offered, and ensure that residential property which are not too trendy are around for young families, getting veterans, as well as people that could have specific limited mode but have saved and you can scraped and therefore are ready to go out there and you may get.

That was Left Unsaid…

Now, whilst appears that brand new Bipartisan Coverage Cardio had written brand new blueprint to your Obama houses bundle, what did new BPC strongly recommend vis-a-vis the borrowed funds focus deduction?

The latest percentage supporting new extension out of income tax bonuses getting homeownership, however, as part of the constant argument more taxation change and you will budget concerns, the fresh payment and additionally advises planning out-of improvement to the incentives so you’re able to allow for increased help to possess reasonable rental housing.

That sound you read is actually the latest sound out of a huge selection of NAR authorities issues anybody rending the gowns into the Washington DC and in Chi town. (más…)